Private Equity:

Fractional

Head of DEI

Unique DEI tools recommended

by ILPA, Level 20 and EDCI.

Trusted by leading Private Equity funds, their portfolio companies and industry bodies

DEI tools made for

Private Equity Funds

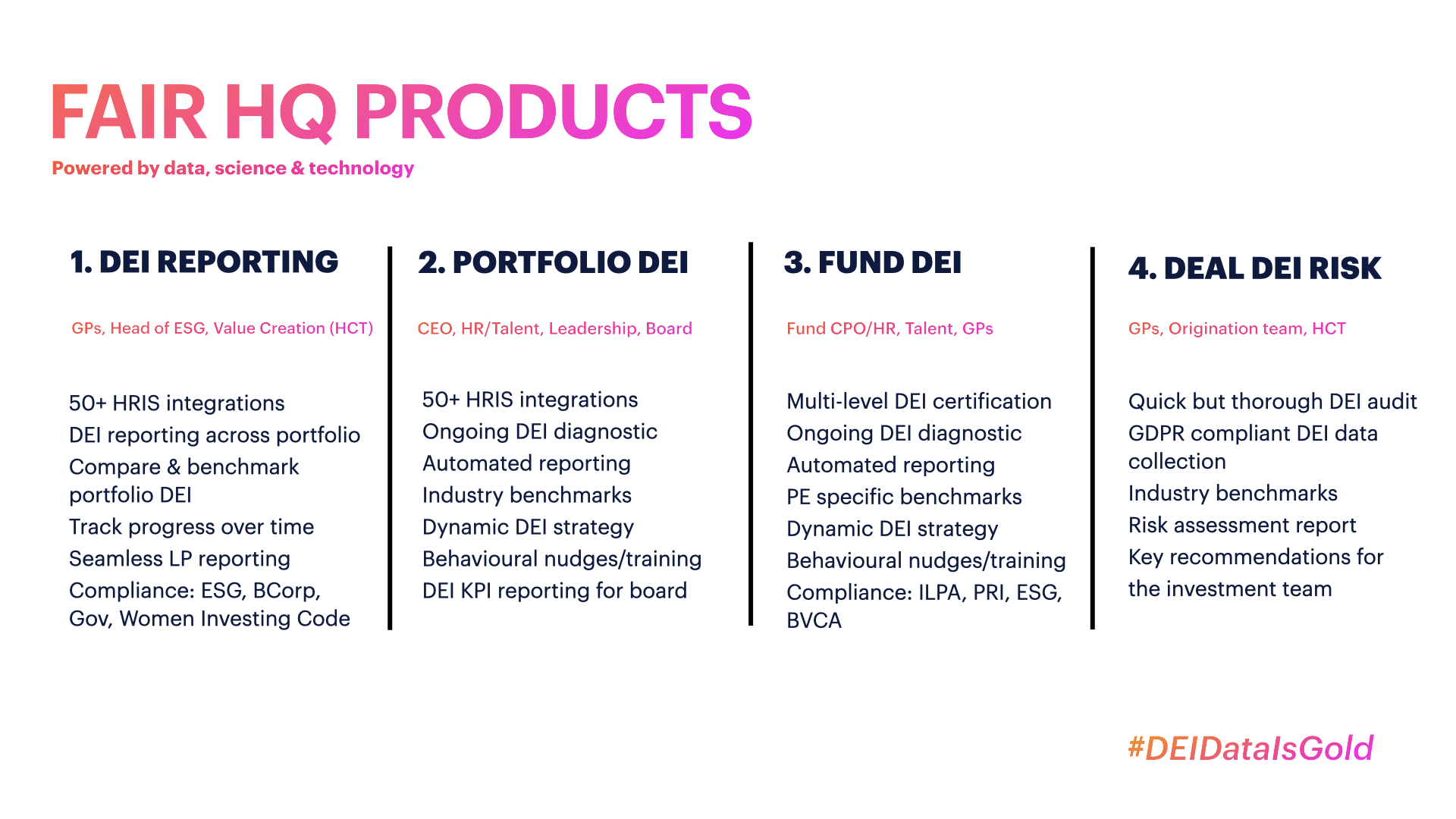

Our DEI products cover:

- GP's Fractional Head of DEI

- Portfolio DEI assessment & support

- DEI reporting tool for ESG & LP

- DEI due diligence for Deal Teams

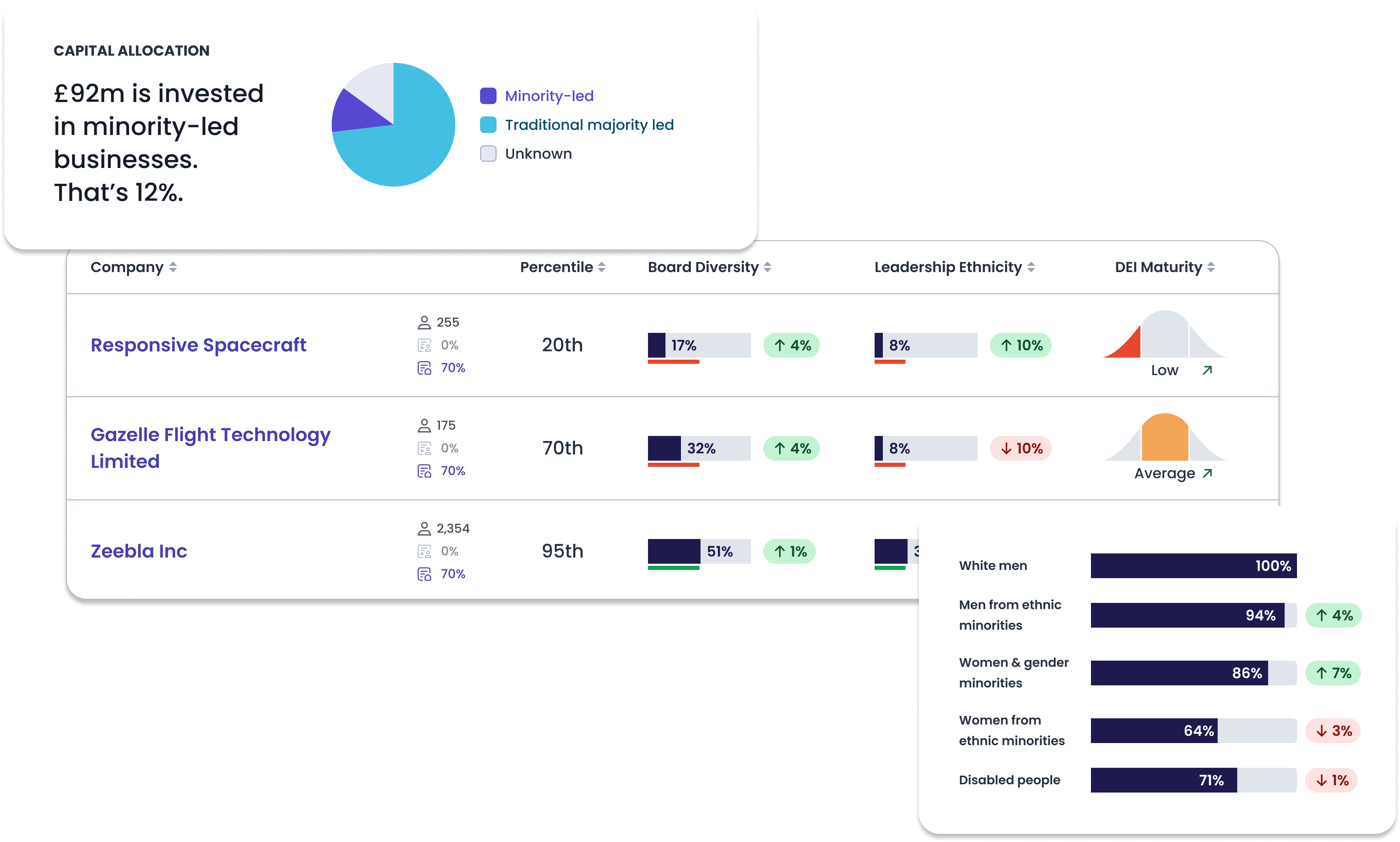

Analyse portfolio DEI at scale

ESG frameworks only scratch the surface, our unique DEI algorithm uses 1,000+ data points collected in hours, not months.

- Systematically identify risks and opportunities portfolio-wide

- Compliant DEI data collection for informed decision-making

- 50+ HRIS integrations (Bamboo HR, Hi Bob, Workday)

- Peer comparison and benchmarking by industry and location

Scalable value creation strategy

Equip PortCos with an affordable Fractional Head of DEI as a SaaS product to support their growth.

- DEI maturity diagnostic for policies, processes & behaviours

- Private DEI surveys uncovering true employee sentiment and identities (GDPR compliant)

- Personalised DEI strategy built on science and data

- Seamless GP & ESG reporting & benchmarking

Get certified and benchmarked

Get recognition for your commitment to DEI with Fair HQ’s Private Equity DEI Certification and know how you compare to your peers.

- DEI diagnostic of operations, deal flow & portfolio support

- Benchmark against similar Private Equity firms

- Personal DEI strategy & support

- Deliver on your commitments to PRI, ILPA, Level 20, EDCI etc.

Deal flow DEI due diligence done!

Objectively assesses both the potential risks and prospects of a fund’s prospective portfolio.

- Ready-made framework for investment teams and potential deals

- Collect data in hours not weeks

- Compare deals to industry & peer benchmarks

Funds like yours know DEI matters

“It was challenging to face the things we could have changed historically that may have led to a more diverse industry. But thoughtful changes over the last few years have already had a measurable impact on our team.”

General Partner, $1.5Bn AUM Fund

“In today’s complex and rapidly changing business environment, having a diverse team isn’t just the right thing to do, it’s a strategic imperative.

That’s why we invest in DEI.”

Senior Partner, $6.5B AUM Fund

“Diversity of investment teams is about ROI. It drives access to higher conviction investment opportunities, it helps break down groupthink with regard to changing trends and market opportunities.”

Investment Director, $3.5Bn AUM Fund

Venture Capital?

We work with you too!

Access to Fair HQ is included with a Diversity VC membership. Together we’re setting the standard for diversity, equity and inclusion in Venture Capital.

Visit Diversity VC now to become a member.