Social KPIs

Management

Platform

For Fund Managers and their Portcos

to track & improve their Social KPIs.

(the S of the ESG)

Trusted by leading Private Equity funds, their portfolio companies and industry bodies

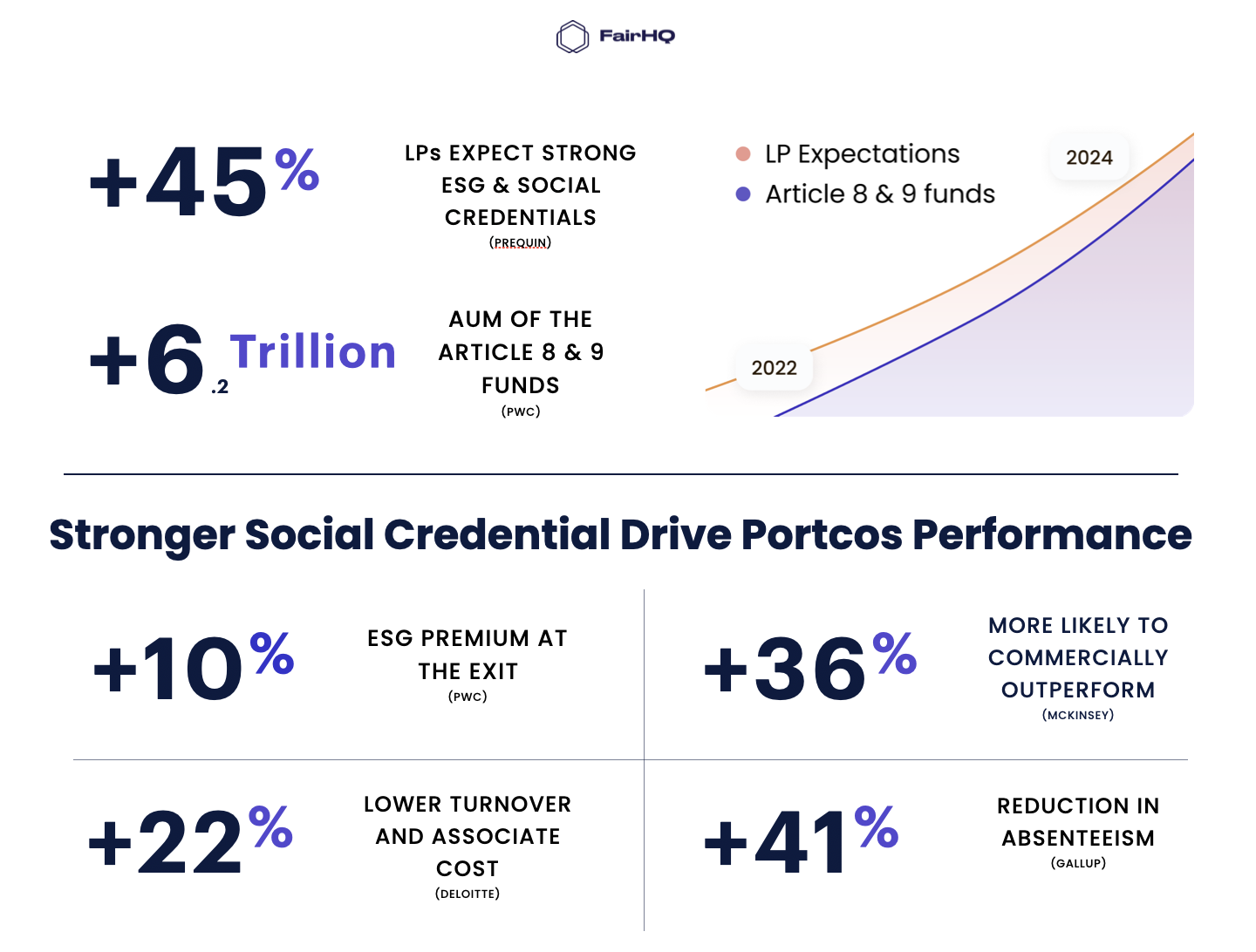

Why Social KPIs matter to Asset Managers?

(and especially to tech, services & health investors with committed Article 8 & 9 funds, where Carbon is less material)

Social KPIs are great for business.

- Raising Funds: 45% of LPs request Social KPIs information during due diligence and expect improvements.

- Portco Performance: Companies with better social credential outperform peers by 36%.

- Exit Valuations: 10% ESG premium, and with so many ESG-focused funds, they are becoming key exit partners.

- Regulatory Pressure: Increased regulatory demands, especially under Article 8 & 9 fund (SFDR) or Pay Equity (UK & Europe).

“We are really excited to be working with the Fair HQ team and making use of their platform to drive the continuous DEI evolution at Apposite Capital.”

Fair HQ is a Proven Tech Partner to Fund Managers.

Here’s how we help them monitor & improve social KPIs in-house and across the portcos.

Track Portcos’

Social KPIs

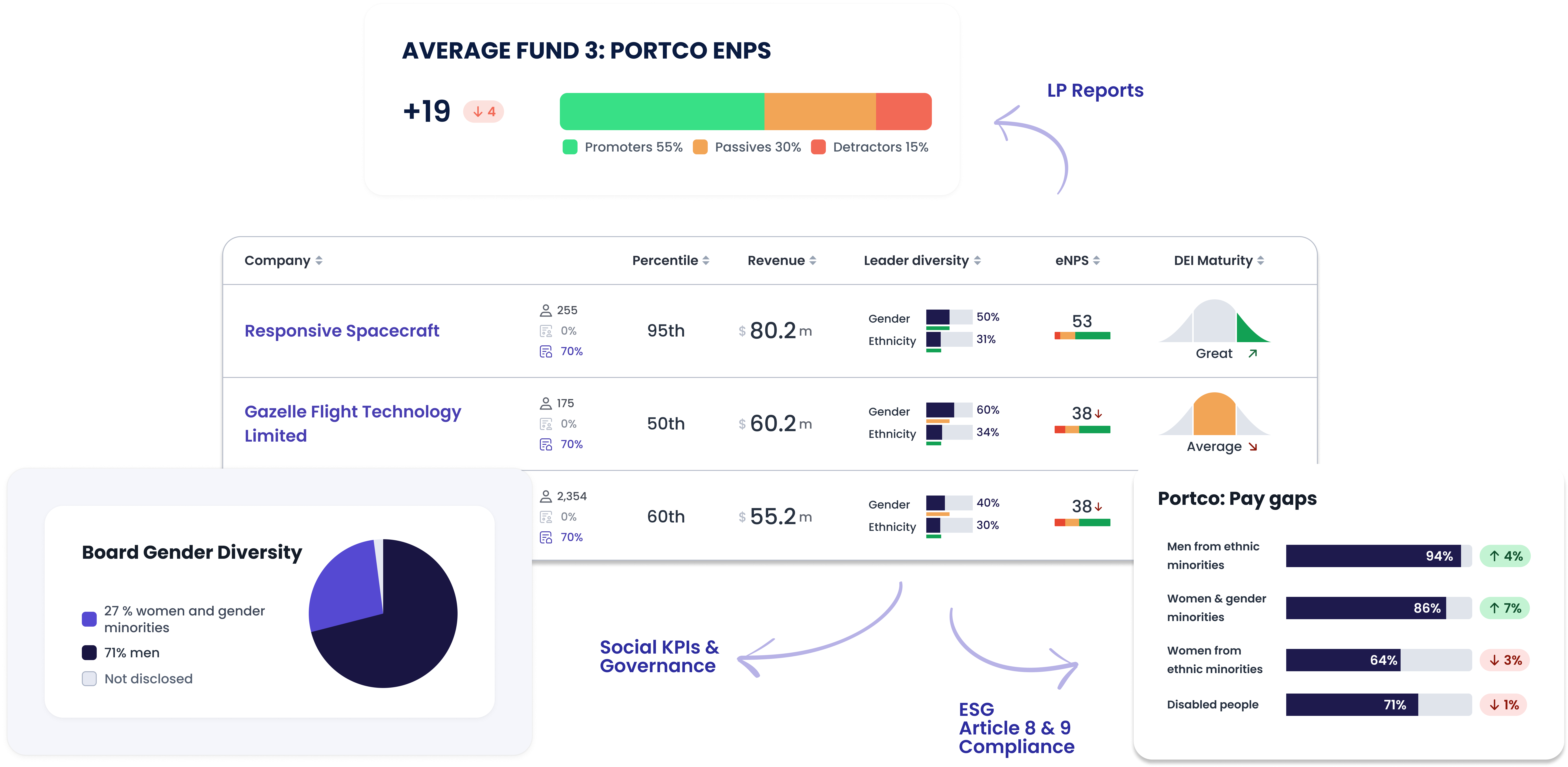

Systemically de-risk and increase the value of your portfolio companies.

- Seamlessly & compliantly collect Social KPIs from your Portcos, such as eNPS, DEI, Workplace Policies & Fairness.

- Collect Diversity Data beyond gender in strict legislative environments in Europe (such as France & Germany).

- Benchmark & rank your portfolio performance against each other and based on their location and industry.

- See what organizations are at risk and which are making the progress.

- Easily fulfill your Article 8/9 reporting requirements and to your LPs, exit partners and the wider community.

Improve Portcos’

Social KPIs

Fair HQ product helps each portco quickly create a science-led strategy tailored to their maturity, size, industry, and business priorities.

- Set Goals that are relevant to each company and aligned with their Business & ESG strategy.

- Improve Social KPIs with tailored data-driven strategies & science-backed actions proven to work.

- Scale best practice policy and process tailored to each Portcos' Maturity & needs.

- Drive fast implementation with step-by-step guides and behavioural nudges that create a high-performing culture of fairness, inclusion, and belonging.

- Track Impact of the strategy on business metrics such as retention risk, productivity, attraction etc.

FOR GPs: Benchmark & Certify Social KPIs

Get recognised as a “Fair Fund” and inspire Portcos & LPs with your approach to Social KPIs. (2h commitment only)

- Conduct Social KPI Audit across your Operations, Investment process & Portfolio Support.

- Survey employees in a secure & confidential way to uncover their experience & plan (eNPS, DEI, Retention Risk, Equal Opportunities etc.).

- Benchmark against relevant Private Equity peers (AUM & no. employees).

- Create & implement data-driven and science led Social Strategy with actions proven to deliver impact.

- Deliver & Report on your commitments to LPs, PRI, DIA (ILPA), Level 20 and more.

What other GPs think about Fair HQ?

“It was challenging to face the things we could have changed historically that may have led to a more diverse industry. But thoughtful changes over the last few years have already had a measurable impact on our team.”

General Partner, $1.5Bn AUM Fund

“In today’s complex and rapidly changing business environment, having a diverse team isn’t just the right thing to do, it’s a strategic imperative.

That’s why we invest in DEI & Social KPIs.”

Senior Partner, $6.5B AUM Fund

“Diversity of investment teams is about ROI. It drives access to higher conviction investment opportunities, it helps break down groupthink with regard to changing trends and market opportunities.”

Investment Director, $3.5Bn AUM Fund

Venture Capital?

We work with you too!

Access to Fair HQ is included with a Diversity VC membership. Together we’re setting the standard for diversity, equity and inclusion in Venture Capital.

Visit Diversity VC now to become a member.